Since project 2 and 3 both have higher PI values than project 1, they should be ranked ahead of project 1 while rationing the available capital. The NPV method reveals exactly how profitable a project will be in comparison to alternatives. When a project has a positive net present value, it should be accepted. 3 5 process costing fifo method When weighing several positive NPV options, the ones with the higher discounted values should be accepted. Anything lower than 1 indicates that the project’s present value is far less than the initial investment. So, the higher the profitability index, the more benefit and value you will get from it.

PI vs. IRR

The profitability index helps compare and contrast investments and projects a company is considering. The PI is especially useful when a company has limited resources and can’t pursue all potential projects. The index can be used alongside other metrics to determine the best investment. When stacked against other investment appraisal techniques, such as NPV and IRR, PI holds its ground by providing a relative measure of profitability, unlike the absolute figures given by NPV. It also avoids some of the pitfalls of IRR, particularly in dealing with non-standard cash flows. The PI ratio uses discounting, the cash flows are discounted by an appropriate rate of return.

- However, the profitability index ratio can be very helpful in assessing the profitability of the projects when used along with other measures of profitability assessment.

- It looks through an investment by accounting for the cost of investment and returns on investment.

- If a PI is less than 1, it suggests that the project’s present value is less than the initial investment, indicating it’s unprofitable and should typically be rejected.

- NPV method is a good measure as well to consider whether any investment is profitable or not.

- It represents the relationship that exists between the costs and the benefits of a potential project.

Effectiveness of PI

It can be very helpful in ranking potential projects in order to let investors quantify their value. This is why PI is a better measure than NPV when it comes to evaluating investments. It looks through an investment by accounting for the cost of investment and returns on investment.

Comparative Analysis

Generating profit and increasing that profit margin is the difference between keeping your doors open or closed. Step 2) As the rate argument, supply the WACC over which the cashflows are to be discounted. Since we have varying cashflows over the years, we will use the NPV function to calculate the present value of these cashflows.

Now we assume that John Brothers can undertake only one of these two projects. The net present value analysis favors project 1 because its NPV number is bigger than project 2. But the profitability index indicates otherwise and says that project 2 with its higher PI value is a better opportunity than project 1. The profitability index rule is a variation of the net present value (NPV) rule. In general, a positive NPV will correspond with a profitability index that is greater than one.

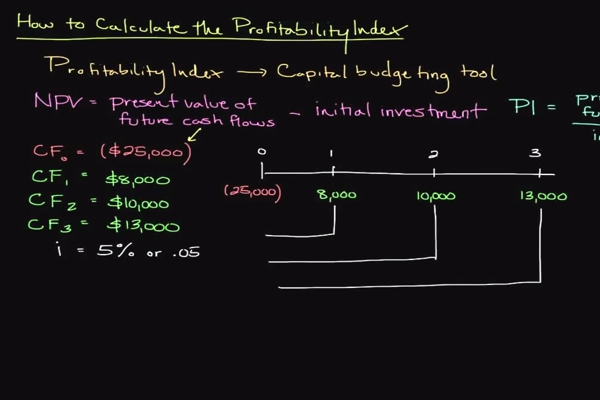

In my professional toolkit, the PI sits alongside other analytical standards such as NPV and IRR, serving as a vital decision-making aide that ensures investments are not just viable but also optimal. The formula for Profitability Index is simple and it is calculated by dividing the present value of all the future cash flows of the project by the initial investment in the project. Additionally, ensure that the cash flows are all either in present or future value before calculation, to avoid mixing values which could lead to an inaccurate PI. Furthermore, PI assumes future cash flows are reinvested at the discount rate, which may not be realistic.

Armed with this information, decision-makers can assess risk-reward ratios, weigh the merits of various investment opportunities, and make informed choices aligned with their financial goals. By streamlining the decision-making process, the calculator empowers investors to navigate the investment landscape with confidence and efficiency. Profitability index is a modification of the net present value method of assessing an investment’s potential profitability. PI ratio compares the present value of future cash flows from an investment against the cost of making that investment.

Through its simple yet effective ratio, PI aids in discerning the relative profitability of various investment opportunities, providing a clear benchmark for comparison. Investment analysis involves assessing various investment opportunities to determine their potential profitability and suitability within an investor’s portfolio. This process is not just about picking winners; it’s a meticulous evaluation of risks, returns, and the alignment of investments with strategic goals. Investment decisions are often complex, involving multiple variables and considerations. The Profitability Index Calculator simplifies this process by providing a straightforward numeric value that investors can use to evaluate the potential returns of a project.